Iran seeks to sell off oil in China before Trump’s return

Iran is struggling with a sharp decline in oil exports to China and seeks to offload reserves stored in Chinese ports ahead of Donald Trump's return to Washington.

Iran is struggling with a sharp decline in oil exports to China and seeks to offload reserves stored in Chinese ports ahead of Donald Trump's return to Washington.

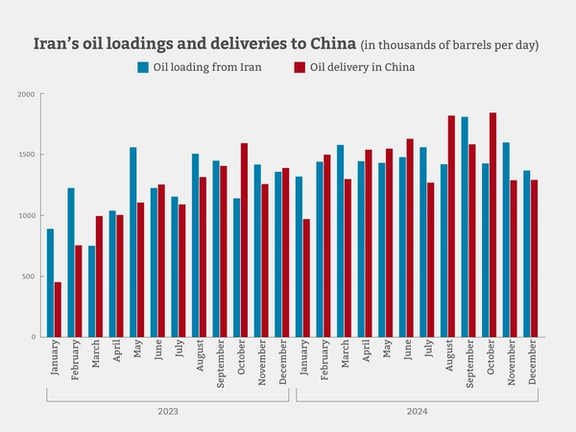

Data from Kpler, a commodity intelligence company that tracks oil tankers, reveals that Iran's oil exports to China have been declining since October. Over the past two months, daily oil deliveries from Iran to China have dropped below 1.3 million barrels, which is 550,000 barrels fewer than in October.

Meanwhile, Iran's unsold floating oil reserves have more than doubled during this period, reaching approximately 20 million barrels.

A source at the National Iranian Oil Company, confirming the significant decline in oil exports, told Iran International that the primary issue lies in logistics. The source explained that recent US sanctions targeting dozens of oil tankers have complicated the transport of Iranian oil to East Asian waters and its covert delivery to China: “Iran hopes to resolve this issue in the coming months by purchasing more tankers,” the source who wished to remain anonymous added.

So far, 380 tankers carrying sanctioned Iranian oil have been identified, with half added to the US blacklist.

Homayoon Falakshahi, a senior Kpler analyst, emphasized the challenges created by recent US sanctions on 35 tankers involved in covertly carrying Iranian oil, noting that half of the so-called "dark fleet" of tankers have been blacklisted.

These mostly old and uninsured tankers play a critical role by turning off their automatic identification systems, transferring cargoes mid-sea to other tankers, altering documents and oil branding via intermediaries, and ultimately delivering the shipments to Chinese ports.

Falakshahi also noted that Iran's only customers in China are small independent refineries known as teapots: “These refineries, due to their low efficiency and high pollution, are under pressure from Beijing to either modernize or shut down”.

Over the past few months, at least three Chinese teapots have officially declared bankruptcy.

Iran's oil reserves in China

In addition to its floating oil reserves, Iran is grappling with challenges related to its oil stocks stored at onshore facilities in Chinese ports.

Recently, Iran International reported, citing an informed source, that the Iranian government, with mediation by the Islamic Revolutionary Guard Corps (IRGC), is attempting to sell $1 billion worth of its oil reserves stored in Dalian Port, China.

The source provided updated information on December 27, revealing that the Iranian government has also launched coordinated efforts to release oil stored in Zhoushan Port, China.

According to the source, Iranian officials have begun investing in renting foreign, non-sanctioned oil tankers to conceal Iran's involvement in these efforts:

"Iran is carrying out operations to load this oil onto these tankers and then move it out of Chinese territorial waters to transfer the cargo mid-sea to other tankers. This is being done to hide the Iranian origin of the oil and to prevent exposure of its release and sale."

It is not precisely clear how much oil Iran has stored in Chinese ports. However, the value of the Islamic Republic's oil reserves in Dalian Port is estimated to be around $1 billion, equivalent to approximately 12 million barrels.

Iran’s oil exports and floating reserves

Kpler data shows that both the loading of oil from Iranian ports and the unloading of Iranian oil at Chinese ports sharply declined during November and December.

In addition to logistical issues and the shutdown of some Chinese "teapot" refineries, Donald Trump’s return to the presidency on January 20 with his pledge to "revive the maximum pressure policy" against the Islamic Republic is another factor behind the sharp drop in Iran’s oil exports to its sole customer, China.

During Trump’s previous presidency, US sanctions imposed on Iran in 2018 reduced Iran’s daily oil exports to below 350,000 barrels in 2019. Before the sanctions, Iran was exporting 2.5 million barrels per day.

Trump’s maximum pressure policy caused Iran’s floating oil reserves to surge to 110 million barrels in 2021. This is partly because some of Iran's oil exports are, in fact, gas condensate, produced from gas fields. If Iran wants to halt condensate production, it would also need to stop gas production, which is not feasible.

At that time, a significant portion of Iran’s floating oil reserves consisted of condensates.

With the surge in Iran’s oil exports to China during Joe Biden’s presidency, Iran delivered a large portion of its floating oil reserves to Chinese refineries. By January of this year, Iran’s floating condensate reserves dropped to zero for the first time since US sanctions, and this trend has continued.

However, since September, Iran’s floating crude oil reserves have doubled due to the decline in Chinese purchases, reaching 20 million barrels. Vortexa estimates this figure to be closer to 50 million barrels.

Iran stopped delivering oil to Syria after the fall of the Bashar al-Assad. However, in the first 11 months of this year, Iran delivered an average of 56,000 barrels of oil per day to Syria.

Overview of exports in 2024

On average, Iran has loaded 1.55 million barrels of oil per day this year, marking a 17% increase compared to 2023. Approximately 94% of these shipments have been delivered to China.

The cessation of oil shipments to Syria this month and the decline in Iranian oil deliveries to China, dropping below 1.3 million barrels over the past two months, come as President Masoud Pezeshkian’s government has set an ambitious target of exporting 1.85 million barrels of oil per day in next year’s budget bill.